Table 6 of GSTR 9: Input Tax Credit (ITC) Reporting Guide

- 10 Sep 25

- 8 mins

Table 6 of GSTR 9: Input Tax Credit (ITC) Reporting Guide

Key Takeaways

- Table 6 of GSTR-9 captures complete details of Input Tax Credit (ITC) availed during the financial year for accurate GST compliance.

- Taxpayers must reconcile GSTR-3B data with GSTR-9 Table 6 to avoid mismatches and ensure smooth return filing.

- Correct reporting of ITC on imports, reverse charge, SEZ supplies, and ISD credits is crucial in Table 6 of GSTR-9.

- Errors in GSTR-9 Table 6 ITC reporting can trigger audits, notices, and compliance issues for businesses.

- Maintaining supporting records ensures transparent reporting of Input Tax Credit in GSTR-9 annual return filing.

Table 6 of GSTR 9 is specifically designed to capture the details of the Input Tax Credit availed during the financial year. Ensuring all of the details are properly filled in Table 6 plays a pivotal role in ensuring accurate annual returns under the GST regime.

It also helps in avoiding discrepancies between the auto-populated data and the actual figures. This article will inform you about the approach that you need to follow to properly fill in all of the details of ITC in Table 6. This will help you in minimising the risk of audits or notices.

How to Fill Table 6 of GSTR 9?

Here's how to fill the Table 6 of GSTR-9:

A: Total amount of Input tax credit availed through Form GSTR-3B

This row is auto-populated with the total ITC availed through Table 4A of GSTR-3B and is non-editable.

B: Inward Supplies (other than imports and inward supplies liable to reverse charge, but includes services received from SEZs)

Here, the taxpayer must disclose ITC on inward supplies other than imports and those liable to reverse charge. However, this includes services received from Special Economic Zones (SEZs), which are categorised into capital, input goods and input services.

Even if reporting capital goods separately is mandatory, the remaining ITC may either be split between inputs and input services or reported entirely under “inputs”. For filling up all of this information, Table 4(A)(5) of FORM GSTR-3B may be used.

C: Inward Supplies liable to reverse charge on which tax is paid and ITC availed received from unregistered persons

6C pertains to inward supplies liable to reverse charge. It includes supplies received from an unregistered person (excluding import of services). Table 4(A)(3) of FORM GSTR-3B can be used as a replacement for the information entered in Tables 6C and 6D.

D: Inward Supplies liable to reverse charge on which tax is paid and ITC availed received from registered persons

6D also pertains to inward supplies liable to reverse charge; however, it includes supplies from a registered person. Taxpayers may either report 6C and 6D separately or combine them in 6D.

E: Import of goods (including supplies from SEZ)

6E captures the ITC on the import of goods, including supplies from SEZ units. Supplies from SEZs made without a bill of entry should not be reported here as they are normal transactions. The ITC must be again classified into capital and input goods. To fill in these details, Table 4(A)(1) of FORM GSTR-3B can be used as well.

F: Import of services (excluding inward supplies from SEZs)

In 6F, the taxpayer should report the ITC availed on the import of services. Only services with a place of supply in India are considered for this category. Table 4(A)(2) of FORM GSTR-3B can also be used to fill in these details.

G: Input Tax credit received from ISD

6G includes the average ITC value, which was claimed on invoices raised by Input Service Distributors (ISD). The values here can be cross-referenced with Table 4A(4) of GSTR-3B.

H: Amount of ITC reclaimed

6H reflects ITC that was reversed earlier but reclaimed within the same financial year.

I: Sub-total (B to H above)

Auto-drafted details that indicate the subtotal of values from Table 6B to 6H make 6I.

J: Difference (I-A above)

6J calculates the difference between the auto-populated value in 6A and the subtotal in 6I. Ideally, this difference should be nil, as the two sections should reconcile.

K: Transitional Credit through TRAN I

This row has the transition credit amount you received in the electronic credit ledger through TRAN-I.

L: Transitional Credit through TRAN II

6L reports the credit amount you received in the electronic credit ledger through TRAN-II.

M: Any other ITC availed but not specified

6M declares the ITC you availed that does not fall under any of the categories listed from rows B to L. It also specifies ITC details availed through FORM ITC-01 and FORM ITC-02 during the financial year.

N: Sub-total (K to M above)

6N is the subtotal of transitional and other credits (Tables 6K to 6M).

O: Total ITC availed (I + N above)

Table 6O reports the total ITC availed, which is the sum of 6I and 6N.

Filling Table 6 of GSTR 9 with precision can be a little time-consuming and needs to be done with accuracy. Taxpayers are advised to keep supporting documentation and GSTR-3B returns readily accessible during this process to make it easier. This is because it ensures direct tax compliance and helps avoid discrepancies during reconciliation.

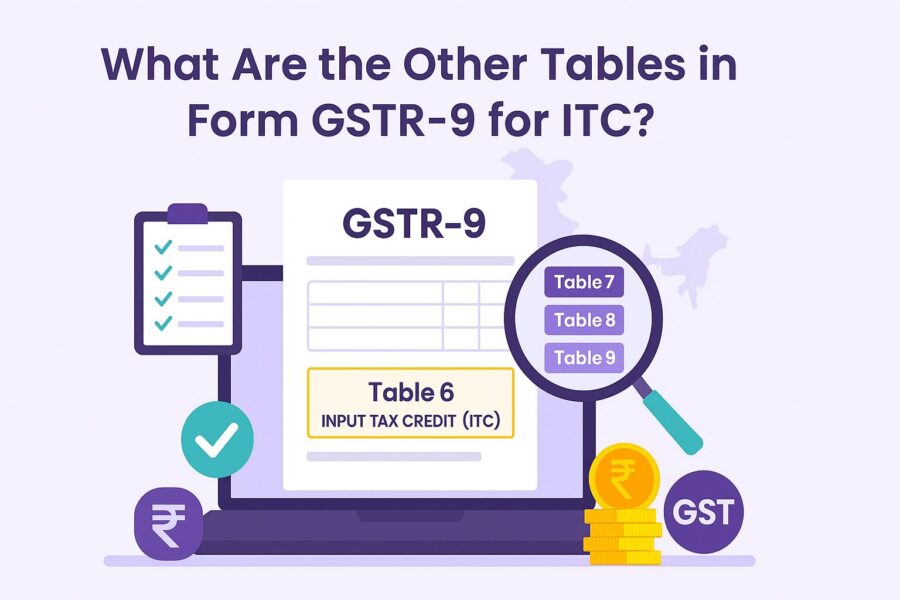

What Are the Other Tables in Form GSTR-9 for ITC?

There are a total of 19 tables in six parts in the form GSTR 9 for ITC. The use of each of these tables is as follows:

| Part | Table | Use |

| Part 1 | Table 1 | Basic details of the taxpayer |

| Table 2 | Financial year details of outward and inward supplies | |

| Table 3 | Details of advances, credit notes, and debit notes related to outward supplies | |

| Part 2 | Table 4 | Details of tax paid as declared in returns filed during the financial year |

| Table 5 | Details of tax refund claimed during the financial year | |

| Part 3 | Table 6 | Details of input tax credit (ITC) availed during the financial year |

| Table 7 | Details of ITC reversed and ineligible ITC | |

| Table 8 | Details of demand and refund reversed | |

| Part 4 | Table 9 | Consolidated details of supplies made to unregistered persons |

| Part 5 | Table 10 | Consolidated details of supplies made to composition taxable persons |

| Table 11 | Relevant details of advances received and adjusted | |

| Table 12 | Details of supplies received from composition taxable persons | |

| Table 13 | Details of supplies received from unregistered persons | |

| Table 14 | Details of supplies received from registered persons other than composition taxable persons | |

| Part 6 | Table 15 | Details of the import of goods |

| Table 16 | Details of the import of services | |

| Table 17 | Details of ITC received from Input Service Distributors (ISD) | |

| Table 18 | Details of other ITC claimed | |

| Table 19 | Details of tax paid and ITC reconciled |

Conclusion

Filling accurate data regarding ITC in Table 6 of GSTR 9 is essential for transparent GST compliance. You need to carry out cross-verification of figures with relevant GST annual returns and records. Through this process, businesses can ensure that the input tax they claim is exactly what they deserve.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.